Emirates NBD

12 Months

5.10% AER | 5.10% Gross

Available through Active Savings

Emirates NBD

12 Months

5.10%% AER

5.10% Gross

(Exclusively) Available through Active Savings

Important information - We provide you with information to help you make informed decisions but it’s not personal advice. You usually can't withdraw your money until the term ends. Inflation reduces the future spending power of cash. Products can be added or withdrawn at any time.

Why Active Savings?

We’re a savings marketplace. Powered by Hargreaves Lansdown, the UK’s largest investment platform for private investors.

By partnering with trusted banks and building societies, we give you access to a wide variety of savings products. All through one online account.

More choice

Save in fixed terms from a few months to several years.

Better rates

Find consistently competitive rates in one place.

Less hassle

Manage savings pots with different banks in minutes.

Emirates NBD

12 Months Fixed Rate

5.10% AER

5.10% GROSS

- Interest paid: Maturity

- Minimum deposit: £1

- Apply by: 25/04/2024

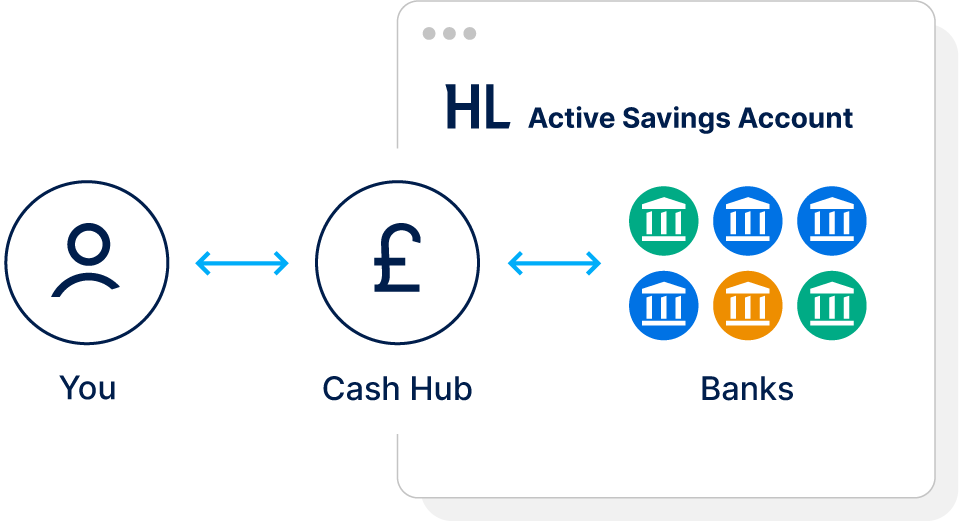

How it works

- Open an Active Savings account

It takes minutes. - Add money to the cash hub

Organise your money using the cash hub. It’s a temporary holding place where you can move your money from. - Choose your savings

Move cash to one or more products and start saving.

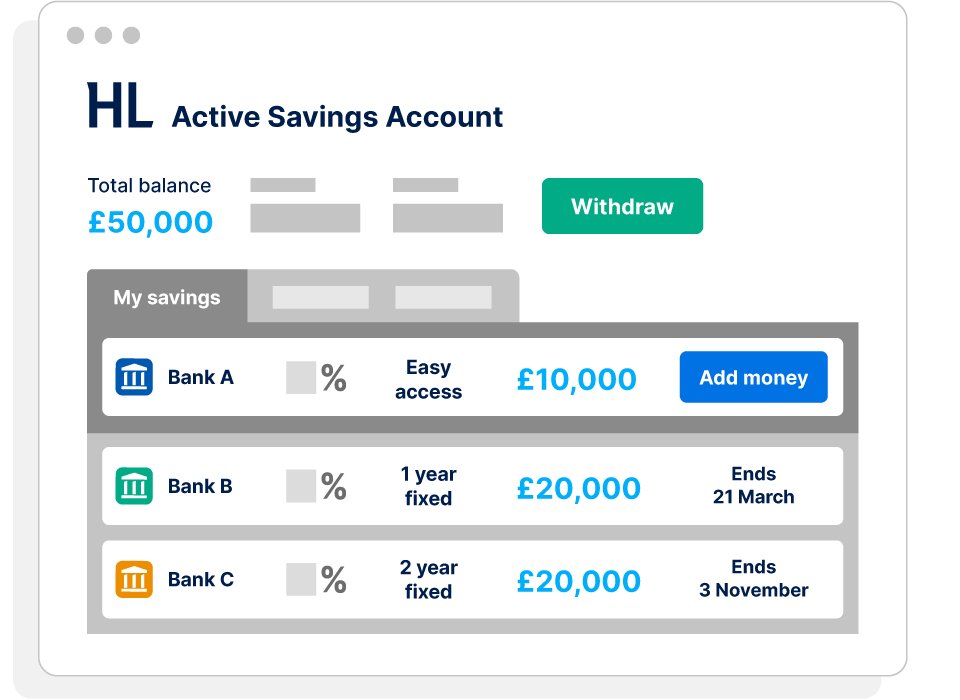

Revolutionise your savings

Move money between banks and products in a few clicks. Add or withdraw money from the cash hub at any time.

See your balance at a glance. Also view a single tax statement at the end of the tax year.

Make life easier at maturity

Tell us what easy access product you'd like to move your money to when your fixed term ends. So you can keep earning interest while you decide what's next.

Active Savings is part of Hargreaves Lansdown plc

- Trusted - A financially secure FTSE-listed company. Helping more than 1.8 million clients save and invest with confidence

- Award-winning - we've won over 200 awards, including Boring Money 2022 Best for Customer Service, and Gold for Customer Experience 2022 Times Money Mentor

- UK-based helpdesk - speak to our customer support team if you have any questions

- Expertise - savings insights from our team of experts

- Ease - check your savings next to any other HL products you might hold

Protection for added peace of mind

Each of the banking partners you save with has Financial Services Compensation Scheme (FSCS) protection up to £85,000. Higher balances can be spread across banking partners for protection.

Money held with Active Savings which isn’t in a savings product is held in the cash hub. Money in the cash hub is kept separate from our own company money in a safeguarded account with Barclays Bank, covered under their banking licence. As we are not a bank, it’s either protected through the Financial Conduct Authority's (FCA) safeguarding rules if we (Hargreaves Lansdown Savings Ltd) were to fail, or the FSCS, if Barclays were to fail.

No charges

We don’t charge you directly, instead we charge our banking partners. This means the same or similar products offered directly by the banks and building societies may have different rates to those available on Active Savings.

The ease with which I can monitor my savings and earn interest, has been inspirational.

MR P DAVIES

HL Awards

BEST FOR CUSTOMER SERVICE 2022

Boring Money

GOLD FOR CUSTOMER EXPERIENCE 2022

Times Money Mentor

Help and support

If you have any questions about Active Savings, you can speak to one of our client support experts.

This website is issued by Hargreaves Lansdown Asset Management Limited (company number 1896481), which is authorised and regulated by the Financial Conduct Authority with firm reference 115248.

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.

Hargreaves Lansdown Asset Management Limited and Hargreaves Lansdown Savings Limited are subsidiaries of Hargreaves Lansdown plc (company number 2122142).

Emirates NBD

12 Months

5.10% AER

5.10% Gross

- Interest paid: Maturity

- Minimum deposit: £1.00

- Apply by: 25/04/2024