Chetwood Bank

24 months

4.01% AER | 4.01% Tax-free

This rate is currently unavailable

Available through the HL Cash ISA

Chetwood Bank

24 months

4.01% AER

4.01% Tax-free

This rate is currently unavailable

Available through the HL Cash ISA

Important information - The information on this page is to help you make your own decisions and is not personal advice. Inflation reduces the future spending power of money. Tax rules for ISAs can change and their benefits depend on your personal circumstances. Fixed term products generally only allow access to your cash at maturity. If you decide to put any of your Cash ISA in a fixed term product, you could be charged if you close or transfer your Cash ISA before the term ends.

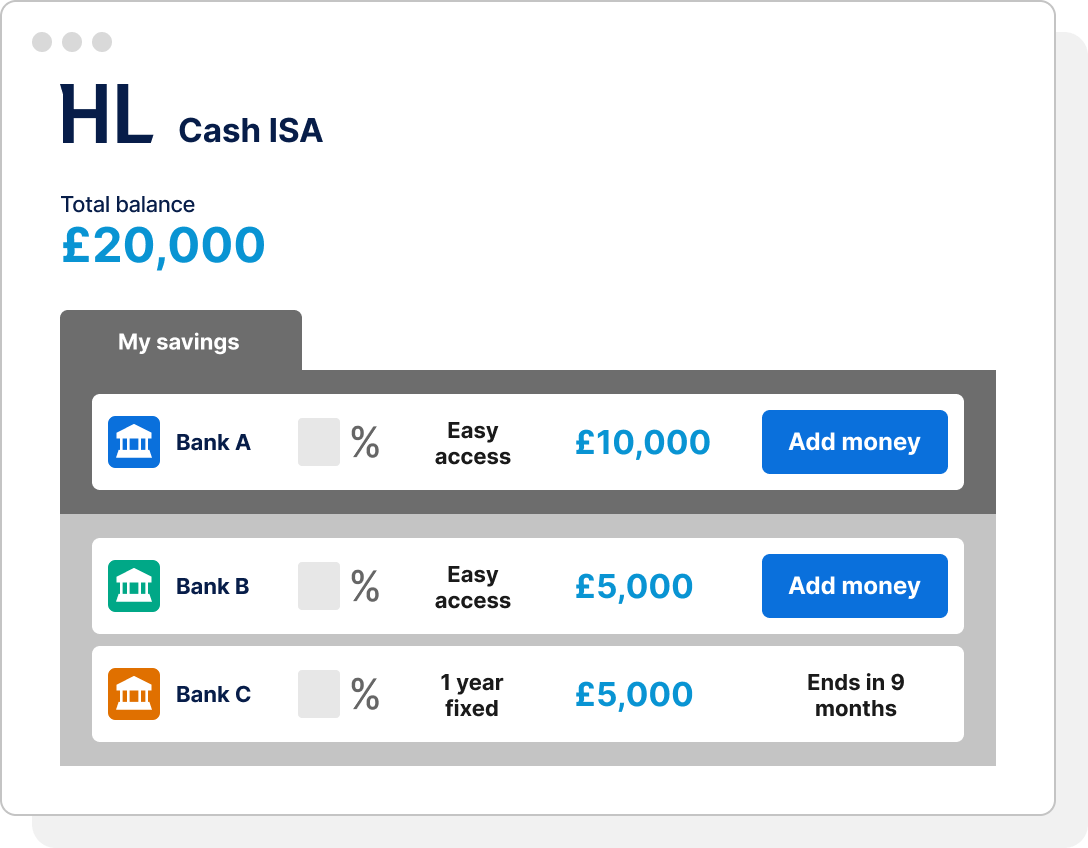

Why the HL Cash ISA?

Spread your ISA allowance across a range of banking partners through one online account.

Pick and mix easy access and fixed rate savings, and pay no tax on the interest.

More interest

Find consistently competitive tax-free rates in one place.

More choice

Save in easy access and fixed rates from a few months to several years.

Less hassle

Manage savings pots with different banks in minutes.

Chetwood Bank

24 months

4.01% AERAER (Annual Equivalent Rate) shows what the interest rate/expected profit rate would be if it was paid and compounded once each year. It helps you compare the rates on different savings products. Once you have opened a fixed term product the rate won't change, but rates on easy access products can vary.

4.01% TAX-FREETax-free interest/profit in the Cash ISA is paid free of UK income tax. Tax rules can change and their benefits depend on your circumstances.

- Interest paid: Annually

- Minimum deposit: £1,000.00

- Apply by: 02/06/2025

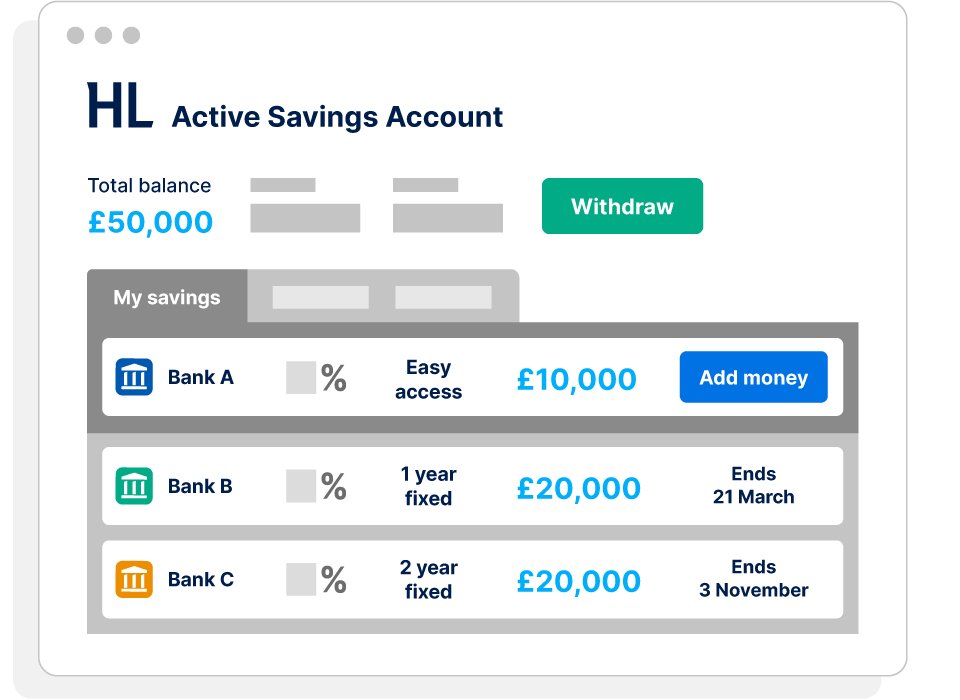

How it works

- Open your account

It takes minutes. - Pick your products

Choose easy access and fixed rates from different banks. - Start earning interest

Move available cash between banks without new applications.

Boost your tax-free interest – ditch the admin

Through one online Cash ISA, you can pick and choose rates from our range of banking partners.

Tailor your savings to your needs

Switch between banks in minutes as your needs change.

See everything in one place

Choose as many products as you like and see them all through one login.

Cut the admin out of earning interest

No new applications when you move between banks.

Powered by Hargreaves Lansdown, the UK’s largest investment platform for private investors

- Trusted by 1.9 million - our clients trust us with over £155bn of their savings and investments

- Award-winning - we've won over 200 awards, including Boring Money 2025 Best for Customer Service, and Finder Awards 2024 for Saving Innovation

- UK-based helpdesk - speak to our customer support team if you have any questions

- Expertise - savings insights from our team of experts

- Ease - check your savings next to any other HL products you might hold

Cash ISA charges

We don't charge you directly to have a Cash ISA, instead we charge our banking partners. This means the same or similar products offered directly by the banks and building societies may have different interest rates to those available through the HL Cash ISA.

Cash ISA transfers

You can transfer money between your HL Cash ISA and HL Stocks and Shares ISA via your account online. Currently, you cannot transfer ISAs from another provider directly to the HL Cash ISA. But you can transfer to the HL Stocks and Shares ISA first, and then transfer into the HL Cash ISA.

Protecting your money

FSCS protected

Money held with one of our banking partners is covered by the Financial Services Compensation Scheme (FSCS). The FSCS will protect your deposits up to £85,000 if the banking partner fails. This limit is per banking licence.

Safeguarding

Money not in a savings product is held by Barclays Bank. Your money is protected under Financial Conduct Authority (FCA) safeguarding rules if HL were to fail and under the FSCS if Barclays were to fail.

The ease with which I can monitor my savings and earn interest, has been inspirational.

MR P DAVIES

HL Awards

BEST FOR CUSTOMER SERVICE 2025

Boring Money

SAVING INNOVATION 2024

Finder Awards

Help and support

If you have any questions about the HL Cash ISA, you can speak to one of our client support experts.

This website is issued by Hargreaves Lansdown Asset Management Limited (company number 1896481), which is authorised and regulated by the Financial Conduct Authority with firm reference 115248.

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.

Chetwood Bank

24 months

4.01% AERAER (Annual Equivalent Rate) shows what the interest rate/expected profit rate would be if it was paid and compounded once each year. It helps you compare the rates on different savings products. Once you have opened a fixed term product the rate won't change, but rates on easy access products can vary.

4.01% Tax-freeTax-free interest/profit in the Cash ISA is paid free of UK income tax. Tax rules can change and their benefits depend on your circumstances.

- Interest paid: Annually

- Minimum deposit: £1,000.00

- Apply by: 02/06/2025